How many times have you heard the phrase, “Invest for the long-run”?

This is a great fallback answer that any traditional investment advisor uses – both in good and tough markets. Yes, the numbers and data support the phrase, but after a year like 2022, the ‘long-run’ can feel really long! Let’s do a quick review to see if such a claim still holds true.

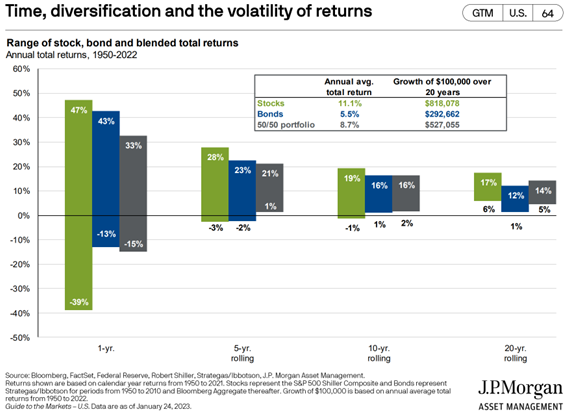

J.P. Morgan produces a great chart, which is publicly available, in their Guide to the Markets publication. The punchline to this chart, which goes back to 1950, helps us see historical returns based on how long you stay invested.

What is the punchline?

I generally look at the five, ten, and twenty year bar graphs. Staying invested for at least five years is generally where the chances of having a positive outcome becomes a much stronger reality. This makes sense because in any five year period, there is generally enough time to work through short-term economic issues.

Despite the difficult year we experienced in 2022, if you were to have invested in the stock market in May 2021 – a mere 22 months ago, you would be positive on your return today. Really?? Yes! You may wonder what the last five years looks like where the economy dealt with oil scares, Covid, and the tough 2022 inflation issues – is the market positive going back five years?

Yes, by nearly an average of 10% each year.

The ‘long-run’ can sometimes seem very long, but time and patience have historically been important characteristics of successful investing. If you believe that humans will continue to innovate and find new ways to grow the economy and be successful at growing the pie, then investing over the long-run has often been a way to participate in that growth.